*This webpage serves as a demo page for display purposes only. The product featured is not currently available.

An account that works for you!

[Bank Name] Business Checking—Made Smarter for Busy Business Owners

Managing your business finances shouldn’t require multiple apps or complicated workarounds. With [Bank Name] Business Checking you get all the features you need in one place—your business checking account.

Make the switch to [Bank Name] Business Checking and experience the power of seamless banking, payments, and financial management—all in one place.

Upgrade to a Smarter Business Checking Account Today

Accept customer payments, automate transaction categorization, and track financial performance in one seamless experience

Get paid faster with built-in invoicing and payment acceptance.

Save time with automated transaction categorization and real-time insights.

Improve cash flow with on-demand financial reporting and funding options.

Keep everything secure and simple by managing your entire financial picture inside online banking.

Everything You Need to Manage Your Business—In One Account

Accept customer payments, automate transaction categorization, and track financial performance in one seamless experience

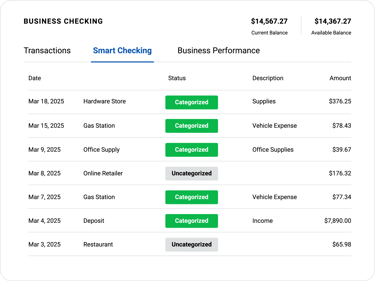

Smarter Transactions

Smarter Transactions

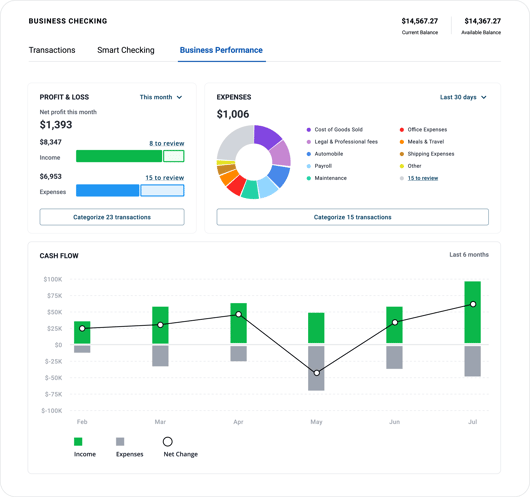

Manage Your Business Performance

Manage Your Business Performance

Track your cash flow, profit and loss and manage customer payment repoting in real-time.

Integrated Digital Payments

Integrated Digital Payments

Accept customer payments online, in-app, or via invoice—deposited directly into your business checking account.

Fast Access to Working Capital

Fast Access to Working Capital

Simplified Business Payables

Simplified Business Payables

Pay vendors and manage outgoing expenses easily, right from your checking account.

[Bank Name] Business Advantage Checking

A business checking account built for busy business owners—[Bank Name] Business [Product Name] Checking integrates essential financial tools directly into your account. Accept customer payments, automate transaction categorization, and track financial performance in one seamless experience.

$25

monthly feeBanking

- Secure and reliable checking account with FDIC protection

- Mobile and online banking access for real-time account management

- Overdraft protection options to safeguard your funds

- Unlimited transactions with no hidden fees

- Fast access to working capital with streamlined approval

Payments

- Accept payments online, in person, or through mobile devices

- Seamless digital payment acceptance, including invoices, payment links, and QR codes

- Payments deposited directly into your checking account—no third-party apps needed

Business Management & Reporting

- Automated transaction categorization for bookkeeping efficiency

- Real-time financial reporting, including profit & loss statements and balance sheets

- Cash flow insights to help manage business finances effectively

- No need for manual exporting to external accounting software

Access to Bank Support & Branches

- Local branch access for in-person service and business banking needs

- Dedicated small business banking specialists for personalized support

- 24/7 online and mobile banking customer service

- ATM access nationwide for convenient cash withdrawals and deposits

Feature |

Benefit |

| Banking Security & Stability | Enjoy the reliability and security of banking with an established financial institution. |

| Seamless Digital Payment Acceptance | Accept customer payments directly into your account—no need for third-party processors. |

| Automated Bookkeeping & Categorization | Save time with transactions automatically categorized and organized for easy financial tracking. |

| Real-Time Financial Insights & Reporting | Gain instant access to profit & loss statements, balance sheets, and expense breakdowns. |

| Built-In Invoicing & Payment Links | Send professional invoices and get paid faster, all from your checking account. |

| Access to Working Capital & Loans | Get funding opportunities based on your transaction history with quick approvals and minimal paperwork. |

| Streamlined Business Payables | Easily pay vendors and manage outgoing business expenses with built-in tools. |

| Mobile & Online Banking Access | Manage your business finances anytime, anywhere, with an intuitive digital experience. |

| Customer & Vendor Tracking | Keep track of who owes you money and manage payment follow-ups effortlessly. |

| No Need for Third-Party Integrations | Eliminate the hassle of syncing accounts with external accounting or payment tools. |

| Unified Personal & Business Banking | Conveniently manage both personal and business finances at your local bank, keeping everything in one place. |