Better Serve and Monetize SMB Relationships

Offer your small businesses a better way to open accounts online, send digital invoices, get paid, and manage finances.

Re-imagine your small business banking journey with Autobooks and Bottomline.

Businesses are shifting online

Business interactions are moving from in-person to online and small business owners are having to adjust - they'll need more than just business checking to succeed.

Autobooks embeds within your digital banking channels so that small business owners can:

- Send digital invoices

- Accept online payments

- Manage their cash flow

- And more

Businesses need to accept online payments

Whether it’s digital invoices or direct payments, businesses need a simple way to get paid online.

With Autobooks inside, a business owner can set up payments to suit their specific needs:

- Customize invoices with business branding

- Adjust payment language for contributions/donations

- Set one-time or recurring payments

- And more

Businesses are turning to non-bank providers (and their deposits are coming with them)

The competition for small business relationships has never been more fierce. New market tech apps and non-bank providers are leading with point solutions like receivables, accounting, or lending and using their strong adoption to expand into to other banking services.

Autobooks with Bottomline re-engages businesses by letting them:

- Receive payments faster

- Deposit funds directly into their business account

- Minimize exorbitant service fees

Small businesses are stuck

Together Autobooks and Bottomline provide tools purpose-built for business owners so they don’t feel “stuck” between retail and commercial platforms not built for their needs.

Transform your existing banking channels into something more:

-

Online and mobile banking becomes the e-commerce hub for all business activities

-

Small business checking becomes the go-to deposit account for all transactions

-

Your institution becomes a trusted partner, improving cross-selling opportunities

Businesses in the U.S. have a cash flow problem (and they need a solution, fast)

Most SMBs only have enough cash on hand to last them 27 days. Ultimately, that’s why 82% of them will fail.

With Autobooks, business owners can be paid as quick as 22 minutes after initial sign up, as well as stay on top of their crucial cash flow needs:

-

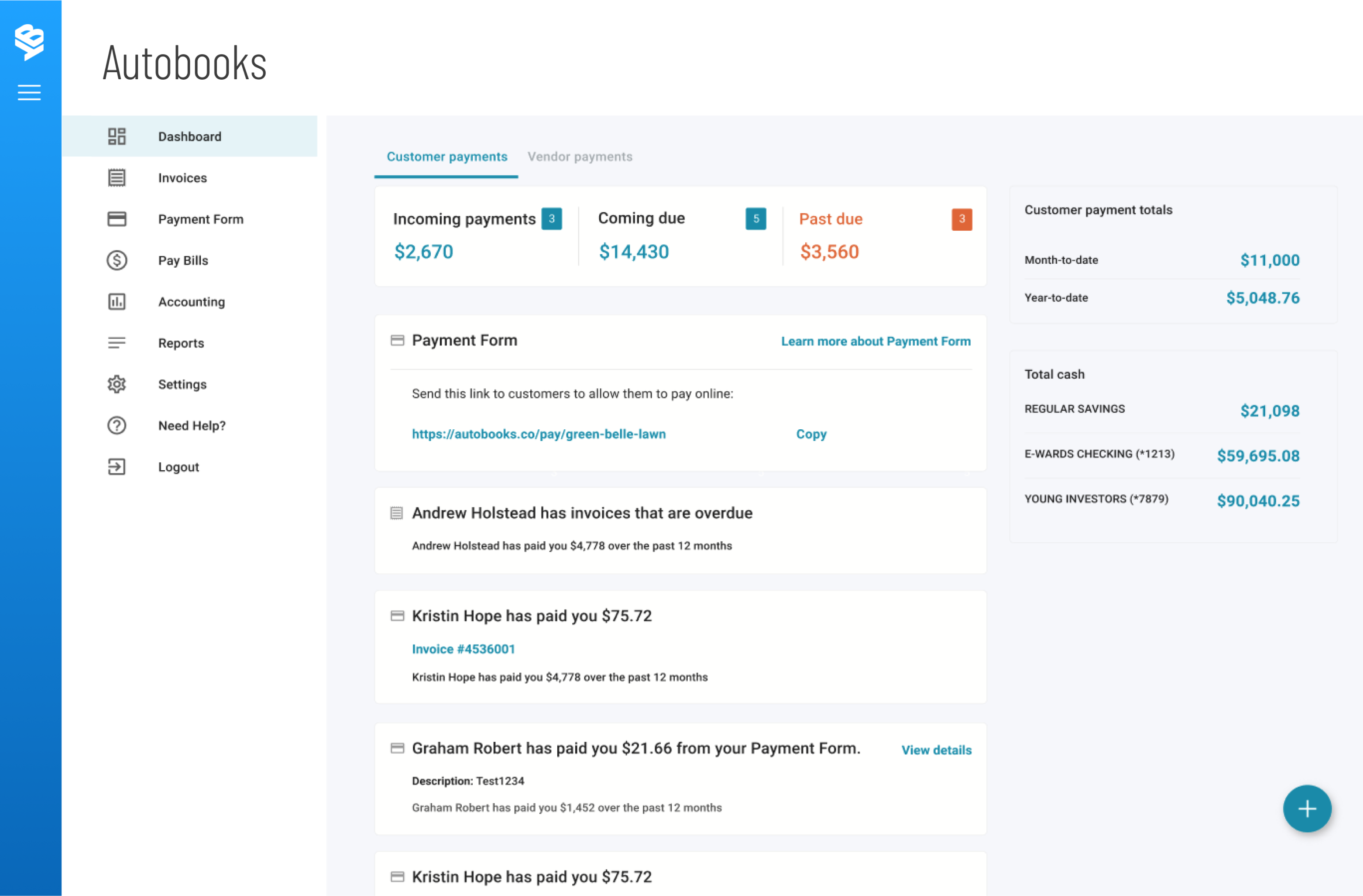

Monitor the automated dashboard for recent customer activity

-

Track incoming, coming due, and past due customer payments

-

Set up invoices to send past due reminders and enable late fees

-

And more

The Challenge

Retaining and winning small business relationships while the gap between what they expect and are offered by financial institutions widens.

Learn more and watch The Financial Brand Brand’s Jim Marous, Ron Shevlin from Cornerstone Advisor and Bottomline’s Norm DeLuca discuss how to proactively engage with small business clients. and provide a new level of service that deepens relationships.

Your FI gets paid when an SMB gets paid Generate non-interest fee income

Earn revenue share when SMBs use Autobooks

Upgrade small business banking with Autobooks — available

through your existing digital platform.

Grow small business deposits and generate non-interest fee income.

Transform online banking into an e-commerce hub for SMB customers.

Support your small businesses with the tools and service they deserve.

Hear what industry leaders are saying about small business banking

Podcast | Smart Banks Can Win in Small Business

Norm DeLuca, General Manager, Bottomline

Norm DeLuca, General Manager Digital Banking Solutions Group, at Bottomline discusses why “this time is different” in terms of digital acceleration and the opportunities that small businesses present, including what banks must do to act on these opportunities right now.

Podcast | Smart Banks Can Win in Small Business

Derik Sutton, VP Marketing, Autobooks

Derik Sutton explains why optimizing cash flow is the number one thing small businesses need from banks during the pandemic crisis — and any other time — and what financial institutions should be doing to get there.

Podcast | Smart Banks Can Win in Small Business

Brett King, Co-Founder, Moven

Brett King, co-founder of neo-bank Moven and host of the world’s first and #1 ranked radio show on FinTech, “Breaking Banks”, explains how institutions must eliminate friction in order to improve the integration or embedded nature, of banking in business customers’ lives.